As the mercury rose in an unprecedented fashion as early as in February this year, I have been busy researching on ways to keep my family in good hydrated condition. Apart from drinking plenty of water, what is of importance in summer, is to have a lot of vegetables/salads, fruits and the right amount of salts/minerals added to fluids. Unfortunately, feeding kids with vegetables and fruits is not exactly a successful mission from my experience and hence I thought of trying various juices, shakes and smoothies this time around.

What is given below is not entirely my inventions but mostly influenced by recipes of Indian summer drinks available on the web. However, since I have been making one different drink per day, I got to experiment a lot with various combinations. The theme is broadly around plenty of citrus juices, seasonal fruits and at times with milk products. My favorite flavors like fresh mint leaves and ginger adding that extra punch.

Before heading on to the recipes, please note that, for the sake of brevity, I am not writing these recipes in professional style. Also, unless specifically mentioned all recipes are to serve two people.

So, here you go.

1. Aloe Vera Lime Juice

Last week, we did a round of pruning of our plants (whatever was left there, that is) in the balcony and got plenty of Aloe Vera rinds. While I was wondering what to do with it, I stumbled upon a recipe on the web which I modified a bit to make this refreshing juice.

Ingredients: Aloe Vera gel – 2 tablespoons, Juice of two Limes, Salt – ¼ teaspoon, Sugar – 4 to 5 teaspoons, Water – 1½ cups, Ice cubes – ½ cup

Method of Preparation: Pour Aloe Vera gel, Lime juice, Sugar, Salt and about 50 ml of water into the blender jar and blend well for about 20-30 seconds. Add the remaining water and ice cubes and blend further for about 10 seconds. Pour into a glass and enjoy!

Tip: Aloe Vera can be mildly toxic if you do not extract the gel carefully. The yellow part or latex between the skin and the gel contains ‘Aloin’ which shouldn’t be consumed at all. If the gel extract is transparent without any traces of yellow (as shown in the picture below), then it’s very safe to consume it. In either case, do not add more than a tablespoon of aloe vera per glass of juice.

2. Double Citrus Juice

Ingredients: Freshly squeezed orange juice of 2-3 navel oranges, Juice of two limes, Water – 1 cup, Salt – ¼ teaspoon, Sugar – 3 to 4 teaspoons, Ice cubes – 4 to 5

Method of Preparation: Just blend everything together in a shaker or blender and enjoy!

3. Spicy Buttermilk

This is something that we used to make back home in Kerala. I just modified it a bit to suit my current taste (medium spicy and mildly sweetened)

Ingredients: Refrigerated curd – 250ml, Water – 150ml, Salt – ½ teaspoon or as per taste, Sugar – ½ teaspoon, Shallots / Sambar onions – 2 to 3, Green Chilli – 1 (small), Ginger – ½ inch, Curry leaves – 7 to 8

Method of Preparation: Blend curd, water, salt and sugar well for about 20 to 30 seconds in a blender / mixer. Coarsely crush pealed shallots, green chilli, ginger and curry leaves in a mortar. Add it to the blender along with the rest and blend for another 3-4 seconds. Refreshing spicy buttermilk is ready!

The color of the buttermilk may vary (light green or mild pink) based on the leading ingredient.

4. Kiwi Smoothie

Kiwi fruits seem to be suddenly cheaper in the Indian markets (due to excess import?). I saw them in the More Supermarket for as low as 14 rupees apiece last week and decided to experiment with the same in multiple ways.

Ingredients: Kiwi fruits – 1 (Pealed and chopped), Chilled milk – 1½ cups, Water – ½ cup, Sugar – 4 to 5 teaspoons, Ice cubes – 5 to 6

Method of Preparation: Blend kiwi fruit pieces, Sugar and water in a mixer or blender for about 30 seconds (or until no small pieces of kiwi fruits are seen). Now, add milk and ice cubes and blend for another 15-20 seconds. Pour into a glass and enjoy the smoothie!

Tip: You can add half a banana, while blending the kiwi, to make it an even richer smoothie with a better flavor. Yes, Kiwi and Banana can go well. In fact, I had made that once but forgot to click a picture

5. Minty Watermelon – Lime Juice

Water melons are indeed the fruit of the season. But did you know that some lime juice and ground mint leaves can turn your humble watermelon juice into an exotic Mocktail?

Ingredients: Cut Watermelon pieces with seeds – 5 to 6 cups, Juice of 1 lime, Fresh Mint leaves – 8 to 10, Salt – ¼ teaspoon, Sugar – 3 to 4 teaspoons, Ice cubes – 5 to 6

Method of Preparation: Blend everything together (including the seeds in the watermelon) for about 20 seconds. Pour into a glass and garnish with 2-3 fresh mint leaves and enjoy!

Tip: Try another variant by replacing mint leaves with ¼ green chilli while blending! This has more punch in it.

6. Lime – Ginger Juice

This is one of my all-time favorites and this is what we usually offer to our guests in the summer.

Ingredients: Juice of 2 limes, Extract of 1” ginger piece, Salt – ¼ teaspoon, Sugar – 4 to 6 teaspoons, Ice cubes – 5 to 6, Fresh mint leaves to garnish

Method of Preparation: Blend everything (except mint leaves) together for about 10-15 seconds or until the sugar completely dissolves. Pour into a glass and top with mint leaves. You can try garnishing with crushed mint leaves as well. I usually, chew the leaves after I finish the juice ?

Tip: In order to extract the ginger juice, first crush it in a mortar without any water and squeeze out the juice. Then crush it again with a teaspoon of water to get some more of it squeezed. Filter this extract before adding to the blender.

7. Lazy Lassi

This is our good old Lassi that doesn’t need any introduction.

Ingredients: Curd – 400 ml, Sugar – 5 to 6 teaspoons, Salt – ¼ teaspoon, Edible Rose Water – ½ teaspoon (OR Cardamom powder ¼ teaspoon), Ice cubes – ½ cup

Method of Preparation: Blend everything together for about 20 seconds, pour into tall glasses and enjoy!

Tip: Many Rose water brands (including Dabur) that you see in the market are good for cosmetic purposes alone and hence not edible grade. Hence, double check before buying the same

8. Kiwi – Lime Juice

This is another super-refreshing drink for the summer!

Ingredients: Kiwi fruit – 1 (Pealed and chopped), Juice of 1 lime, Sugar – 4 to 5 teaspoons, Salt – ¼ teaspoon, Water – 1 ½ cups, Ice cubes – ½ cup

Method of Preparation: Blend kiwi fruit pieces, Lime juice, Sugar and Salt along with some 50 ml of for about 30 seconds so that a neat pulp is formed. Add the rest of the water and ice cubes and blend well. Pour into a glass of water and consume immediately (If you are storing in the fridge, mix well before drinking as kiwi juice – just like freshly made pineapple juice – will have the fruit parts floating after a few minutes)

Bonus Tip

Convert it into something exciting: Barring the ones featuring milk products, any of the above drinks can be quickly converted into a summer cocktail by adding 30 to 45 ml of your favorite spirit while blending ?

Make these summer coolers at home and let me know how they turned out to be.

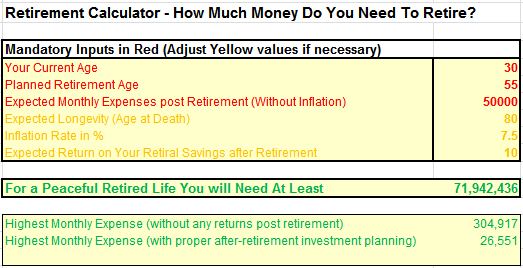

of 43 years after careful deliberation and planning for retirement over the last few years. I worked for exactly 19 years in the IT Industry which thought is equivalent to some 30 years of efforts in the Indian context; that is, when you consider the first ten years of hard work and extra hours that we all had to put in during those years.

of 43 years after careful deliberation and planning for retirement over the last few years. I worked for exactly 19 years in the IT Industry which thought is equivalent to some 30 years of efforts in the Indian context; that is, when you consider the first ten years of hard work and extra hours that we all had to put in during those years.