Today is my last working day in my fulltime Software career. Yes, I decided to retire at my current age  of 43 years after careful deliberation and planning for retirement over the last few years. I worked for exactly 19 years in the IT Industry which thought is equivalent to some 30 years of efforts in the Indian context; that is, when you consider the first ten years of hard work and extra hours that we all had to put in during those years.

of 43 years after careful deliberation and planning for retirement over the last few years. I worked for exactly 19 years in the IT Industry which thought is equivalent to some 30 years of efforts in the Indian context; that is, when you consider the first ten years of hard work and extra hours that we all had to put in during those years.

Nevertheless, I decided to call it quits mainly due to the following reasons:

- I was kind of getting bored with the IT office routine – while Software still excites me, the industry quite doesn’t anymore

- I thought I have planned my finances reasonably well till today after initial years of spend-thrift lifestyle. At the moment though, I have no loans, have some decent savings and fixed assets, and I have further plans to appreciate whatever little wealth I have)

- I do not want to improve my lifestyle or living standards further or better than what it is now. In fact, I already froze my lifestyle some five years ago

- I plan to leverage on my secondary skills and hobbies in order to earn some income from home. This, at the moment, cannot immediately match the high salaries that IT professionals command – it is more about doing what you like the most and have huge potential to outsmart the IT salaries

- I see the need to spend more time with my family with my kids (a special one too) growing up – I believe that after certain age, one’s sole goal should be grooming the next generation and giving back all your learning to the society

The reasons may be reasonable but can one really retire so early without having some planning and backup? Well, that’s what we are going to discuss in this post. I am writing this post because I thought it might help a younger guy out there who wants to plan for his retirement. It is very obvious that one needs quite some money to retire and hence it needs careful planning! I shall also share here the little Excel sheet that I made sometime back to help with my retirement planning.

How to plan for your early retirement?

Disclaimer first: I am not a financial adviser nor planner myself. However, based on the personal finance articles that I got to read in newspapers and online over the past several years, I kind of figured out how much money I might need to retire early and more importantly, if that money is not sufficient, how can I supplement it further? (In fact, that’s more like my situation now). In my case, the plan was laid out almost 8 years ago and I kind of executed it more or less along the expected lines. I must however admit that I didn’t fully reach my financial goals yet, and hence it is all the more important to discuss the management of post-retirement savings as well. We will discuss both these aspects in the post.

If you ask me about early retirement planning, the following will be the logical steps involved.

- Decide at what age you want to retire from your full-time job; Do that at least 10-12 years in advance so that you don’t miss any wealth creation opportunities.

- Project your typical monthly expenses post retirement (without considering inflation parameters; planning tools will take care of adjusting for inflation) and hence the amount you want to retire with for a longevity of say 80 years

- Execute your plans to save up that much money – The plan should include foreclosing any pending loans before retirement, a clear strategy for pre and post retirement investment, onetime big expenses etc. Also, do special planning for high-inflationary expenses such as medical (You need a good medical insurance for your family post retirement) and a term-life insurance well in advance

- If the return on retiral investment do not seem sufficient, plan for a backup part-time job or go for alternate investment instruments (often high-risk, high-reward ones if you are retiring at a younger age)

- Retire peacefully and enjoy those little things in life!

Now, that sounds easier said than actually done but it’s not that easy! Let’s now take a closer look at our planned steps. I shall try to explain these steps in detail using the little Excel sheet that I was talking about (download link below).

Step 1. At what age do you want to retire?

To begin with, you need to make up your mind to arrive at a reasonable retirement age. This has to be done very well in advance. For example, when you are still in your early thirties, you may plan for a retirement at 45 if you are sure of saving up enough. Be careful not to be super-confident here. In my case, I started thinking about retirement about 7-8 years back itself after seeing a few ups and downs in the industry as well as the financial markets. More often than not, people won’t take a retirement call out of fear or social reasons – because it may be seen as a sin by old thinkers!

Your readiness for retirement again can be checked using my sheet. If you are not ready yet, use the sheet again to decide how can you accelerate your investments towards achieving your retiral goals (i.e. the money with which you can retire. Remember to add additional investments for special needs such as kids education or marriage, if such events are likely to happen post your retirement. You may use the third sheet in the workbook for such goals and add up to your systematic investment goals)

Step 2. Project your monthly expenses

This is reasonably easy if you have the habit of tracking your monthly expenses. If not, do the following:

– From all your bank statements, find out your annual account outflow (withdrawals, bills payments,credit card payments)

– Deduct the expense types that won’t happen post retirement (e.g. kids schooling expenses – not always though, fuel adjustments when you don’t commute that often, shopping budget as applicable etc)

– Add any additional expense that might recur after retirement (e.g. medical insurance)

– If there are things that repeat every couple or few years, add those expenses on an annualized basis as well (e.g. family vacation abroad once in two years)

– The resultant value divided by 12 would be roughly your monthly expenditure.

– If you want, more accurate values (advisable) please track your expenses from today itself.

Now, this monthly expenses should be on as-is basis. i.e. if you decide to retire today, how much you will need after cutting anything that’s not applicable in retirement life is this monthly figure we are talking about. Don’t worry about any inflation parameters at this moment.

Step 3. Execute your plan based on your particular sheet

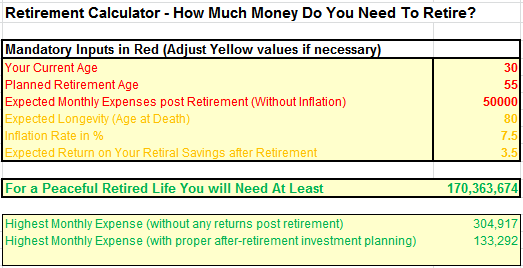

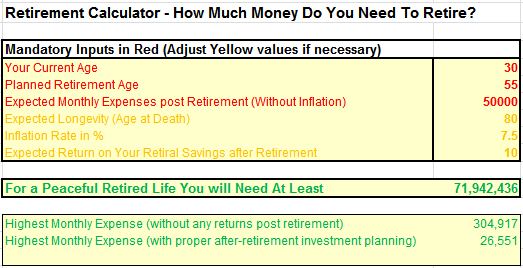

Now, it’s time to take a closer look at your sheet. After entering the mandatory fields of your current age, retirement age and expected monthly expenses, you may adjust the inflation parameter and the expected returns on your savings after retirement. The inflation parameter in Indian conditions can be anywhere between 6 to 10 percent over a long period of time. The rate of returns on your investment can be as low as 3% for savings banks, 7 to 10 percent in long term deposits and 8 to 12 percent typically in equities (and as high as 15-20 percent in certain time horizons in the bull market).

I suggest to leave the longevity at 80 years as that’s typical life expectancy number that one should plan for. The life expectancy in India is slowly going up thanks to advancement in medical facilities and health standards.

With that plan in the sheet, you now know how much you need to save up. You need to document that somewhere and not keep it transient in the sheet (and you forget your planned numbers later).

Now, the preparation steps start. Some of the activities you need to undertake during this 8, 10 or 15 year period is to close all your loans, take care of major one-time expenses or allocate further money for that, and take a term insurance policy at a good age (typically before 40 years and preferably in early 30s).

(Note: As a thumb rule, one should de-link insurance and investments. There’s no point in having an old style endowment policy like the one LIC used to offer. Instead, earmark most of that money into high-return investments and use only a fraction of the cost for a high value term deposit. These days, taking a 50L or 1 Crore term insurance policy is not a big deal!)

Living frugally and investing wisely should be the motto towards the retirement age. Especially, one should go for things that add long term value than disposable/expensive items (e.g. smartphones, electronics, changing cars frequently etc).

No matter what, your end-goal on retirement day should be having that magic figure that you want to retire with.

Some of the wise things to do on retirement is to dispose illiquid assets such as real estate, gold* etc. Also, try to invest 20-25% of your take home salary in equity market (blue chip) and mutual funds prior to your retirement. One good thing to do is to allocate 10 to 15% of your take home salary towards EPF (Pension Fund or Provident Fund) on top of the employee+employer contribution. This comes as a big savior at the end because it’s all tax-free amount that returns at an average of 8.5% over the past several years. It’s as good as getting 12% annualized returns before tax. I was doing exactly the same since 2004-05 and it really helped me!

* By the way, responsible citizens should avoid gold as an investment instrument as this illiquid and stagnant wealth – while giving you good returns – will spoil the country’s economy. Our biggest curse is the trade deficit caused by Petroleum and Gold imports.

Step 4: Special risk planning

Now, what if you slogged it out till your retirement day and you still are not going to make the money you wanted as per the planning sheet? (Don’t worry, that will be the case with most people)

You have to either (1) Go with some high-risk, high-reward schemes or (2) Plan for a part time activity that earns some money to supplement your retirement savings returns with which you can make a living.

(1) is where I disagree with the old school of thought. Yes, it’s ideal to invest all your post retiral savings into risk-free and fixed return instruments AS LONG AS you retired with a handsome amount in your bank. And that’s indeed the recommendation for those who retired rich. What if you didn’t and you are still rather young?

In such cases, you need to maximize your returns from your post retirement money by investing part of it into the equity market. Why? Because it returns like 10% or 12% annually on your retirement savings and you are going to beat the inflation big time.

Also, please note that the risk scenario mentioned here is applicable ONLY when you couldn’t take that risk before retirement. It is always better to take this kind of risky investment before retiring itself, as much as possible.

Negating the bad effects of Inflation is the key to be successful in Indian conditions!

You may compare the two sample screenshots below to understand what I am talking about.

If that’s not your preferred route, you need to definitely do some kind of part time activity that earns money (in my case, that’s the plan!)

Step 5: Happily Retire!

No explanation needed here, but all that you have to do is to go for a good medical insurance coverage, bifurcate your money into the right investment instruments and enjoy life! Because you have done your planning part really well, you deserve to enjoy life to the fullest till the very end!

Early Retirement Hassles (Non-financial)

When somebody decides to retire so early in their life, the biggest worry is to manage and convince the family members. In the Indian context, you will invariably have an argument with your spouse on your decision. Even worse will be the nosy friends and the family people who will be waiting for an opportunity to prove you wrong for not thinking like the most! At any point of time when things don’t seem to go well, you have to remind yourself that your conviction is better than the conventions you see around!

Further, some people might develop boredom and depression after an early retirement decision. That’s why it is very important to find a post retirement activity to keep you occupied and happy. Retirement life is a very good time to reconnect with your family, friends and rediscover yourself. You will also find a lot of time to take care of your health.

The above are some of the non-financial aspects that you need to manage and figure out to lead a peaceful life, after having done the financial part perfectly right!

Enjoy your life!

PS: This article was written in a hurry as I really wanted to post it on my retirement day itself! Any suggestion, corrections are welcome and let me know if the Retirement planning Excel sheet that I shared has any bugs or calculation issues!