‘Growth or appreciation’ is the primary goal of any stock investment regardless of your time horizon and risk profile. Dividends, buyback opportunities, merger-demerger benefits etc are secondary, although still significant in providing additional advantages to your equity portfolio. But when it comes to the best stocks to invest for long term, you need to be choosy. More importantly, you need to be aware of exactly where you want to put your hard-earned money into.

Just going by that primary definition of ‘appreciation’ let me explain an easy way of picking safe and sure-shot long term portfolio stocks. I have two objectives here – first, to explain this simple methodology of picking steady growth portfolio stocks and second, to share a portfolio of 12 solid large cap stocks that one can blindly invest and forget for the next 10 or 20 years to build massive wealth. Well, I am not talking about lump sum investment here but one can keep buying these twelve stocks at every market correction opportunity OR at regular intervals (SIP) in order to build long term wealth. This is also an attempt answer some of the queries that I keep getting from the readers of this blog regarding steady portfolio stocks for long term.

The Method of Picking Steady Growth Stocks or Best Stocks to Invest in India for Long Term

Now, over to the methodology – It’s actually a pretty simple technique and no rocket science. Please follow the following steps to arrive at your final list.

Step 1: First you have to make an initial list of about 50 stocks from multiple sectors/industries. This initial list can be easily made by taking all 30 Sensex stocks plus say 20 big names from the NSE Top 100 list. If you are confused here, start with the list of top 100 stocks in NSE itself.

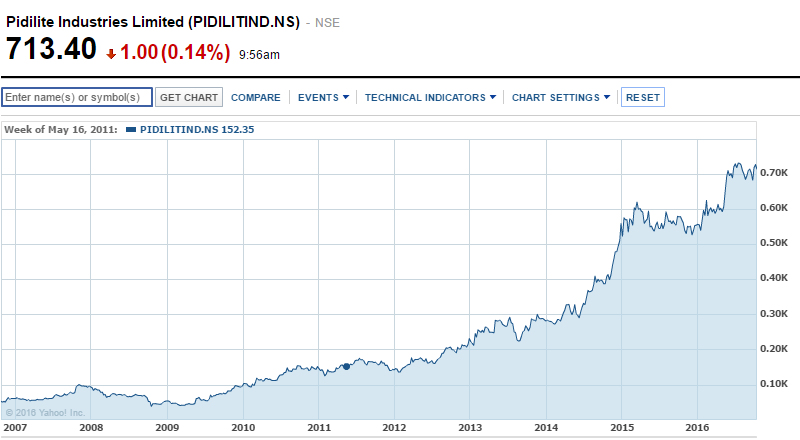

Step 2: Now, since our aim is price ‘appreciation’ in the long term, we need to have a look at the long term chart of these companies. You can use Yahoo finance, Money Control or NSE / BSE charts to see the 10 year or 15 year chart of the companies shortlisted from Step 1. In this step, you have to pick all those companies which have a steadily upward going chart (which of course indicates price appreciation). E.g. the charts of HDFC Bank or Asian Paints look exceptionally good and not that of SBI or ONGC. Discard all those companies that don’t have a smooth upward looking price journey and you will be left with 15 or 20 good growth stories (price-wise or chart-wise)

Step 3: This list, of say 20 companies that have great looking charts, has to be further scrutinized for good growth parameters. Here, I simply look at the RoE (Return on Equity), RoCE (Return on Capital Employed) and Sales and Profit parameters of these stocks. I usually use the Screener site to check these parameters. For long term growth stocks, a steady RoE of say above 15 (preferably 20+), RoCE of above 20 (Preferably 25 or 30) and a positive sales and profit growth in double figures is more than enough. Don’t be surprised if you notice companies with an RoE of 50 or RoCE of 200 plus.

Step 4: Most of the stocks with from Step 2 and 3 may be having good growth parameters. Now, to drop a few more, please take a look at their Debt / Equity ratio, again using Screener. Here, for long term stocks, I would drop all those companies that have a Debt to Equity ratio of more than 25% (0.25). Ideally, one should pick zero debt companies here or the ones with Debt / Equity ratio as zero or nearly zero. Please note that in the case of Banking, Financial and NBFC stocks, one shouldn’t look at this ratio, as their primary business itself is borrowing and lending

The above four steps would leave you with a dozen or so stellar performers that you can invest in for solid long term gains.

Good and Not-So-Good long term charts

Here’re some examples of typical charts to go for, as discussed in Step 2. Please note that one has to look into the 10 or 15 year chart and NOT 2 or 5 year charts while hunting for potential long term portfolio stocks.

Exceptional growth stocks with great charts

Decent companies with poor long term charts

Well, these are still portfolio stocks for historic reasons but they don’t necessarily fetch you the desired price appreciation. On the other hand, just by looking at their charts, one can figure out that they are good for medium term trading point of view whereby they offer many up and down cycles in the long term charts.

My list of 12 Buy-and-Forget Long Term Portfolio Stocks

Based on the above screening, the following would be my list of the best stocks to invest in India for long term. Ten of them are index stocks while two others are high growth non-index stocks with proven track record and continuous growth in the future as well.

1. Asian Paints Ltd

2. Bajaj Auto Ltd

3. Bajaj Finance Ltd

4. HCL Technologies Ltd

5. HDFC

6. HDFC Bank Ltd

7. Hindustan Unilever Ltd

8. Lupin Ltd

9. Maruti Suzuki Ltd

10. Pidilite Industries

11. Yes Bank Ltd

12. Zee Entertaintment Ltd

Now, all those who are looking for multibagger recommendations, from a few months point of view, may ask yourselves the following question. Would you put your hard-earned money in risky multibagger stocks OR in safe, established businesses that can return 10 or 15 times over a ten year period?

Happy Investing!

(Standard disclaimer: I am not a qualified investment advisor. Do your own research before investing or consult a certified financial advisor. I personally hold some of the above stocks in my long term portfolio)

Dear sir, am big fan and follower of your blog…. You have recommended long term stocks in 2015 and 2017 I am in little bit confusion which one to invest for next 15 to 20 years please guide in this regards

Nithin, what I listed last year were Midcap stocks. This new list here is purely large cap stocks (mostly Sensex / Nifty stocks) with proven track record of growth. For your time frame of 15-20 years, you can start investing in this large cap list of stocks in a SIP manner. You can also add couple of stocks from the other (midcap) list too as and when they correct. Stocks like Aurobindo Pharma, Bharat Forge, DHFL, Motherson Sumi, UPL from the other list are solid bets but you would see that their long term charts suggest too much of run up in the last couple of years. Hence take always the SIP route.

Sir, thank you very much for your good suggestions. I am very glad sir.

Nice Post after a long time..

Very nice and helpful blog. I rarely find such crisp and easy to understand explaination.

Thank you very much.

Sir suggest any small cap stock

Sintex Plastic Technologies is one stock I plan to buy. It seems to be bottoming out.

Sir, do you suggest buying Subex,suzlon energy,IDFC and DHFL right now ?

Looking to keep them for long term

Sorry for the late reply. I do hold Subex and IDFC, but I don’t think they are great stocks for a long term portfolio. DHFL is a good stock at correction. I wrote about Suzlon, Subex etc as potential turnaround candidates with a lot of risks attached.

I got an amount of Rs. 20 Lakhs and willing to invest in long term wealth creation. Please advice accordingly. I am 70 years old enjoying good health and I shall be buying them for my son and grand son. I got few stocks already worth 4 lakhs in holding. should I need to sell them when they do not perform well or just treat them like HDFC bank? Many advisors and friends recomended 20 stocks from Nifty 50….please advice me …..