Today is my last working day in my fulltime Software career. Yes, I decided to retire at my current age  of 43 years after careful deliberation and planning for retirement over the last few years. I worked for exactly 19 years in the IT Industry which thought is equivalent to some 30 years of efforts in the Indian context; that is, when you consider the first ten years of hard work and extra hours that we all had to put in during those years.

of 43 years after careful deliberation and planning for retirement over the last few years. I worked for exactly 19 years in the IT Industry which thought is equivalent to some 30 years of efforts in the Indian context; that is, when you consider the first ten years of hard work and extra hours that we all had to put in during those years.

Nevertheless, I decided to call it quits mainly due to the following reasons:

- I was kind of getting bored with the IT office routine – while Software still excites me, the industry quite doesn’t anymore

- I thought I have planned my finances reasonably well till today after initial years of spend-thrift lifestyle. At the moment though, I have no loans, have some decent savings and fixed assets, and I have further plans to appreciate whatever little wealth I have)

- I do not want to improve my lifestyle or living standards further or better than what it is now. In fact, I already froze my lifestyle some five years ago

- I plan to leverage on my secondary skills and hobbies in order to earn some income from home. This, at the moment, cannot immediately match the high salaries that IT professionals command – it is more about doing what you like the most and have huge potential to outsmart the IT salaries

- I see the need to spend more time with my family with my kids (a special one too) growing up – I believe that after certain age, one’s sole goal should be grooming the next generation and giving back all your learning to the society

The reasons may be reasonable but can one really retire so early without having some planning and backup? Well, that’s what we are going to discuss in this post. I am writing this post because I thought it might help a younger guy out there who wants to plan for his retirement. It is very obvious that one needs quite some money to retire and hence it needs careful planning! I shall also share here the little Excel sheet that I made sometime back to help with my retirement planning.

How to plan for your early retirement?

Disclaimer first: I am not a financial adviser nor planner myself. However, based on the personal finance articles that I got to read in newspapers and online over the past several years, I kind of figured out how much money I might need to retire early and more importantly, if that money is not sufficient, how can I supplement it further? (In fact, that’s more like my situation now). In my case, the plan was laid out almost 8 years ago and I kind of executed it more or less along the expected lines. I must however admit that I didn’t fully reach my financial goals yet, and hence it is all the more important to discuss the management of post-retirement savings as well. We will discuss both these aspects in the post.

If you ask me about early retirement planning, the following will be the logical steps involved.

- Decide at what age you want to retire from your full-time job; Do that at least 10-12 years in advance so that you don’t miss any wealth creation opportunities.

- Project your typical monthly expenses post retirement (without considering inflation parameters; planning tools will take care of adjusting for inflation) and hence the amount you want to retire with for a longevity of say 80 years

- Execute your plans to save up that much money – The plan should include foreclosing any pending loans before retirement, a clear strategy for pre and post retirement investment, onetime big expenses etc. Also, do special planning for high-inflationary expenses such as medical (You need a good medical insurance for your family post retirement) and a term-life insurance well in advance

- If the return on retiral investment do not seem sufficient, plan for a backup part-time job or go for alternate investment instruments (often high-risk, high-reward ones if you are retiring at a younger age)

- Retire peacefully and enjoy those little things in life!

Now, that sounds easier said than actually done but it’s not that easy! Let’s now take a closer look at our planned steps. I shall try to explain these steps in detail using the little Excel sheet that I was talking about (download link below).

Step 1. At what age do you want to retire?

To begin with, you need to make up your mind to arrive at a reasonable retirement age. This has to be done very well in advance. For example, when you are still in your early thirties, you may plan for a retirement at 45 if you are sure of saving up enough. Be careful not to be super-confident here. In my case, I started thinking about retirement about 7-8 years back itself after seeing a few ups and downs in the industry as well as the financial markets. More often than not, people won’t take a retirement call out of fear or social reasons – because it may be seen as a sin by old thinkers!

Your readiness for retirement again can be checked using my sheet. If you are not ready yet, use the sheet again to decide how can you accelerate your investments towards achieving your retiral goals (i.e. the money with which you can retire. Remember to add additional investments for special needs such as kids education or marriage, if such events are likely to happen post your retirement. You may use the third sheet in the workbook for such goals and add up to your systematic investment goals)

Step 2. Project your monthly expenses

This is reasonably easy if you have the habit of tracking your monthly expenses. If not, do the following:

– From all your bank statements, find out your annual account outflow (withdrawals, bills payments,credit card payments)

– Deduct the expense types that won’t happen post retirement (e.g. kids schooling expenses – not always though, fuel adjustments when you don’t commute that often, shopping budget as applicable etc)

– Add any additional expense that might recur after retirement (e.g. medical insurance)

– If there are things that repeat every couple or few years, add those expenses on an annualized basis as well (e.g. family vacation abroad once in two years)

– The resultant value divided by 12 would be roughly your monthly expenditure.

– If you want, more accurate values (advisable) please track your expenses from today itself.

Now, this monthly expenses should be on as-is basis. i.e. if you decide to retire today, how much you will need after cutting anything that’s not applicable in retirement life is this monthly figure we are talking about. Don’t worry about any inflation parameters at this moment.

Step 3. Execute your plan based on your particular sheet

Now, it’s time to take a closer look at your sheet. After entering the mandatory fields of your current age, retirement age and expected monthly expenses, you may adjust the inflation parameter and the expected returns on your savings after retirement. The inflation parameter in Indian conditions can be anywhere between 6 to 10 percent over a long period of time. The rate of returns on your investment can be as low as 3% for savings banks, 7 to 10 percent in long term deposits and 8 to 12 percent typically in equities (and as high as 15-20 percent in certain time horizons in the bull market).

I suggest to leave the longevity at 80 years as that’s typical life expectancy number that one should plan for. The life expectancy in India is slowly going up thanks to advancement in medical facilities and health standards.

With that plan in the sheet, you now know how much you need to save up. You need to document that somewhere and not keep it transient in the sheet (and you forget your planned numbers later).

Now, the preparation steps start. Some of the activities you need to undertake during this 8, 10 or 15 year period is to close all your loans, take care of major one-time expenses or allocate further money for that, and take a term insurance policy at a good age (typically before 40 years and preferably in early 30s).

(Note: As a thumb rule, one should de-link insurance and investments. There’s no point in having an old style endowment policy like the one LIC used to offer. Instead, earmark most of that money into high-return investments and use only a fraction of the cost for a high value term deposit. These days, taking a 50L or 1 Crore term insurance policy is not a big deal!)

Living frugally and investing wisely should be the motto towards the retirement age. Especially, one should go for things that add long term value than disposable/expensive items (e.g. smartphones, electronics, changing cars frequently etc).

No matter what, your end-goal on retirement day should be having that magic figure that you want to retire with.

Some of the wise things to do on retirement is to dispose illiquid assets such as real estate, gold* etc. Also, try to invest 20-25% of your take home salary in equity market (blue chip) and mutual funds prior to your retirement. One good thing to do is to allocate 10 to 15% of your take home salary towards EPF (Pension Fund or Provident Fund) on top of the employee+employer contribution. This comes as a big savior at the end because it’s all tax-free amount that returns at an average of 8.5% over the past several years. It’s as good as getting 12% annualized returns before tax. I was doing exactly the same since 2004-05 and it really helped me!

* By the way, responsible citizens should avoid gold as an investment instrument as this illiquid and stagnant wealth – while giving you good returns – will spoil the country’s economy. Our biggest curse is the trade deficit caused by Petroleum and Gold imports.

Step 4: Special risk planning

Now, what if you slogged it out till your retirement day and you still are not going to make the money you wanted as per the planning sheet? (Don’t worry, that will be the case with most people)

You have to either (1) Go with some high-risk, high-reward schemes or (2) Plan for a part time activity that earns some money to supplement your retirement savings returns with which you can make a living.

(1) is where I disagree with the old school of thought. Yes, it’s ideal to invest all your post retiral savings into risk-free and fixed return instruments AS LONG AS you retired with a handsome amount in your bank. And that’s indeed the recommendation for those who retired rich. What if you didn’t and you are still rather young?

In such cases, you need to maximize your returns from your post retirement money by investing part of it into the equity market. Why? Because it returns like 10% or 12% annually on your retirement savings and you are going to beat the inflation big time.

Also, please note that the risk scenario mentioned here is applicable ONLY when you couldn’t take that risk before retirement. It is always better to take this kind of risky investment before retiring itself, as much as possible.

Negating the bad effects of Inflation is the key to be successful in Indian conditions!

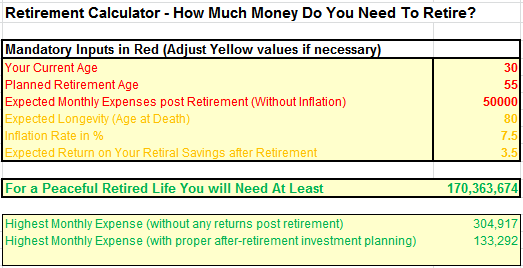

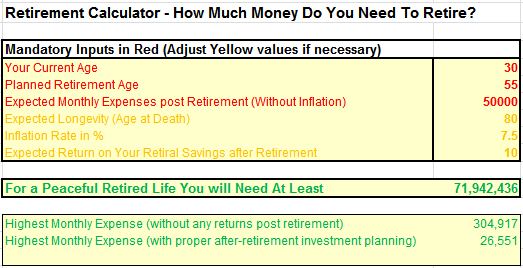

You may compare the two sample screenshots below to understand what I am talking about.

If that’s not your preferred route, you need to definitely do some kind of part time activity that earns money (in my case, that’s the plan!)

Step 5: Happily Retire!

No explanation needed here, but all that you have to do is to go for a good medical insurance coverage, bifurcate your money into the right investment instruments and enjoy life! Because you have done your planning part really well, you deserve to enjoy life to the fullest till the very end!

Early Retirement Hassles (Non-financial)

When somebody decides to retire so early in their life, the biggest worry is to manage and convince the family members. In the Indian context, you will invariably have an argument with your spouse on your decision. Even worse will be the nosy friends and the family people who will be waiting for an opportunity to prove you wrong for not thinking like the most! At any point of time when things don’t seem to go well, you have to remind yourself that your conviction is better than the conventions you see around!

Further, some people might develop boredom and depression after an early retirement decision. That’s why it is very important to find a post retirement activity to keep you occupied and happy. Retirement life is a very good time to reconnect with your family, friends and rediscover yourself. You will also find a lot of time to take care of your health.

The above are some of the non-financial aspects that you need to manage and figure out to lead a peaceful life, after having done the financial part perfectly right!

Enjoy your life!

PS: This article was written in a hurry as I really wanted to post it on my retirement day itself! Any suggestion, corrections are welcome and let me know if the Retirement planning Excel sheet that I shared has any bugs or calculation issues!

Hi Ajith,

Great and insightful blog.

Wishing you all the very best and happiness for the near future.

Cheers,

Sachin.

Sachin,

Realized that I didn’t reply to your comment 🙁 Where are you these days. Thanks for all the wishes.

Cheers,

Ajith

Hey Ajith, I knew you will be posting an article on this development. You are one of the lucky few, who could retire this early. Enjoy your retirement life with your family.

All the best..!

Thank you George. I am not really lucky as you perceived (i.e. Not strong on personal finance part yet). But I hope to continue doing some part time activities to raise just enough money to make myself and the family happy. No over ambitions for the future nor major achievements in the past 🙂

Hi Ajith,

All the Very Best for a peaceful retirement life!! Live life to the fullest.

Thanks,

Ram

Thanks Ram 🙂

Hi Ajith,

I’m very happy to see software person getting early retirement! I’m inspired by your blog. I would also be thinking in same way. I set myself to retired from IT by 48.

Thanks,

Satish

Thanks for your comment Satish. Early retirement is mainly to focus on other important priorities in life 🙂 As a matter of fact, I have forgotten a lot more other things in life after joining the Software career. Need to get back to things that matter more – one at a time…

Good luck for your retirement plans!

Hi Ajith,

Wish you the very Best!

(You have written this article in an excellent manner! I think you can earn through writing itself 🙂 )

Regards

Chitra

Thanks Chitra. In fact, blogging and related online marketing is what I am planning to do 🙂

Hi Ajith – Been a long time since I visited your blog. Wish you all the very best for a new and happy innings without the shackles of corporate life ! Will be eagerly following for updates !

Hey Sushil, Good to hear from you man… Sure, I will keep providing the updates on this blog or FB.

Dear Ajith,

Very inspiring.

Best regards,

Yogesh Malpani

Thanks Yogesh 🙂

Dear ajit,

i wanna invest in a life retirement insurance for myself. Would lic or sbi be a good option?… which one do u suggest?

Kashish, I have both – LIC was taken some 18-20 years back when I didn’t know what investment is all about. And I have this SBI term policy.

I suggest that you de-link insurance from retirement planning. For insurance needs, one should always take a term policy of 50L or 1 Cr or even higher depending on your family needs. I don’t believe in taking an endowment policy which is more like giving back the amount you paid (and you paid a lot as premium when the money had value).

Hi Ajith,

First of all congratulations on taking this decision. Many of us want to but keep on pushing back things as we are unsure of the future. And in the process compromise with the present.

Would need some more tips on retirement. Let me know how to connect.

I am 43 and planning to retire next year. Accordingy to you how much money is needed with no financial obligations and no kids to worry about? Also, with monthly passive income of Rs.3000/- per month.

Well, it depends on your monthly expenditure right? If you can manage your expenditure within that, why not? However, if your monthly expenditure is 3000 per month now, you will need 6000 rupees per month ten years from now and around 13000 in twenty years – due to inflation. You need to plan for that.

Hello,

Good Read. I think while calculating the retirement money you should take account the inflation. For example suppose I required 20k per month for my expenses so without inflation even after 20 years I required the 20k per month.

Regards

-Mohit

Mohit, inflation is already included in the calculator.

Hi Ajith,

All the very best for a peaceful retirement life!!!!

It was a very inspiring and thoughtful blog….Kudos !!!!

Please let us know what should be the ideal size of family based on which the retirement calculator is designed for arriving at figures(i.e. 2 + 1 or 2 + 2 or 2 +3).

Ravindranath, There’s no ideal size as long as you have calculated your monthly expenses right (and covered yourself with a good term policy and your family with a medical floater)

Hi Ajith,

Actually…I was trying to check the figures by changing values in C6 cell of excel with 40 , 45 , 50 , 55, 60 years by keeping all other values the same…However, I notice that the required amount calculated for peaceful retirement life is increasing in numbers….Ideally, the retirement corpus should decrease with postponement of retirement age as per my understanding….

Please could you help me understand how this calculator works….

Thanks

Ravindranath

Hi Ravindranath,

Thanks for your question. The retirement corpus can reduce with postponement of retirement ONLY if you have a favorable inflation rate OR a higher return on your retirement money. If the inflation is very high (or close to return on retiral money) you will see a drop in corpus required at a very late stage (May be a C6 value of 66 or 67 – check at that point and beyond) only.

In other words, the calculator calculates your living expenses needs from the date of retirement till longevity.

Hi Ajith,

Thank you for providing us a view into the future.

Howver, could you clarify on “Expected Monthly expense post retirement”. Is it our expected expense on the first month post retirement or today which might be 20 years before retirement?

Nishanth,

It’s the monthly expense if you decide to retire TODAY. The tool will calculate the impact of inflation automatically.

Please note that your monthly expense on retirement may not be exactly your current monthly expense (A few spend items may go off due to life style changes).

For more details, please check the Help tab on the sheet.

hi..

i understand that section was for gold related queries…so i m again posting the query. Please suggest as per your experience and keen understanding of the volatile market,is the interest paid on ppf account the same no matter which bank one chooses…

i m completely new in the investment field…i wanna save for a comfortable and dignified retirement life…i m not very ambitious…but my main aim is to have financial security and hopefully when i retire, i should have the freedom to travel all over the world and yet be assured i would have enough to last for a lifetime. Ajith..could u suggest the funds …the approach i could take if i wanna invest for a long term period…i m 26…i can invest for upto 20 or 25 years…

moreover, ajith…i do find your choice of home-based jobs fascinating, as i, too, find blogging…online marketing..to be a great outlet for my creativity

Thanks

PPF is same in post office or any nationised bank in India. It’s better to open the same in any of the SBI branches.

The following investment plan may help you retire with massive wealth. The earlier you start, the better.

1. Allocate 35% to 40% of your take home salary purely towards investment. Any other expense, rent, loan etc should be outside this allocated amount. Basically, never compromise on the investment part. A lot of people make the mistake of buying fancy apartments, cars or gadgets by compromising their investment potential.

2. Your first priority and safe investment should be your EPF if you are working in an organization with PF. EPF has got two components ER (Employer) and EE (Employee). What you have to do is to send a mail/advice to your payroll team and asking them to allocate twice as much more of your EE component towards EPF every month. E.g. if your employee monthly contribution is 3000 rupees, ask them to deduct 6000 more from your salary and move towards EPF. This will build massive wealth over a period of 20 or 25 years. Please note that as your base salary increase, please keep putting more into EPF.

If your employer doesn’t have EPF, please opt for a PPF account.

3. The remaining part (i.e. 35% or 40% of take home minus EPF contribution as mentioned in 2), should be allocated towards equity based mutual funds. What I suggest you is to invest in 4-5 different equity funds (never put all your money in just one or two funds) via Systematic Investment Plan whereby you allocate a fixed amount per month. If you are SIPing 5 equity funds for 20 years or so, you are definitely going to build massive wealth. For example, if you had invested 1 Lakh in HDFC equity fund 12 or 13 years back, it’s worth 30Lakhs now. No real estate or gold investment can match that kind of returns.

Some of the good funds to invest are:

– HDFC Equity Fund

– Birla Sunlife Top 100 fund

– ICICI Prudential Top 100 fund

– Birla Sunlife Pure value fund

– Principal growth fund

– HDFC Top 200 fund

– Franklin India smaller companies fund

(There are many more)

4. Don’t waste your money on gold and real estate – they are both difficult to protect. Further, gold is a shame on India and is a damaging asset to the economy. Real estate may be an investment only if you are going to buy a flat or home where you and your family stay. Also, avoid direct investment in stocks UNLESS you understand the stock market very well.

5. As a thumb rule, NEVER withdraw money from the PF until your wealth is built to a considerable level. For specific purposes, such as kids education/marriage etc, allocate separate mutual funds allocations.

6. If the EPF interest rates (lowest has been 8.25% per annum tax free which is equal to 12% with taxing. Highest in the last fifteen years have been 12% = 17% with taxing) fall considerably low (e.g. less than 7%) in the coming years, move the EPF allocation too to equity mutual funds. Also, keep revisiting if your SIP funds are doing good over a period of time. Think of switching away to new funds ONLY once in a year or two.

Would like to hear from you, fifteen or twenty years from now on your success story…

Thank you and good luck to you,

Thanks ajith, its very gracious of u to take time to guide me. Hopefully, it will be a success story indeed!

Hi Ajit,

I also think in the same way. I am 35 yrs old right now and planning to get retired at 40.This approach should be followed by more and more high paid job professionals ,so that it will help to give job opportunities to young Indians and by early retirement we can give time to hobbies/ creativity ,which may also generate new jobs for others.

Suryakant Tiwari

Hi,

Nice write up Ajith,

I was in such impression that only i am the person who thinks for early retirement from my job life, but after reading your blog and others comments, i am feeling good that there must be thousands of people thinks in such direction. I am now 31 years old. I have planned my early retirement from the age of 22 i.e before my marrraige. I worked really really hard to achive my each goals. Now as i am feeling that my saturation level has reached. I will take retirement from my job life from January 2015. I am getting monthly rent approx 250000/- from my properties, my installment of loan is 95000/- so I will get approx 150000/- every month after paying bank installments. Another option is that if I sell my properties and pay my loan early. I have to rely on interest money that will be approx 300000/- monthly ( 9.5% yearly on FD). What is ur suggestion? Should I sell my property and repay loan.or pay monthly installments from my rent ? Which one will be more safe?

Jatin, great job for creating these high rent yielding assets at such an early age..just that you have neglected the tax aspect on sale of property and rental income .Post tax returns may be lower .

Hi ajith,

I just goggled retiring early in India and landed up here.Most of the write ups are of phirangis usually.The word retirement irks my family to the core.They feel retiring early means i will become useless and wont have any income to support.What will u do ?Are u stupid ? I get these FAQs not only from elders but also from my friends.. Frankly i am fed up with my stupid corporate job and i think life has much more to offer than 9 to 5 ..I am really pushing hard to achieve my goal to retire ASAP ..

BTW i think financial planning is a good business for part timers..

Hi I am 48 years old and plan to retire at the age of 52 years.Liability only will be the marriage of 2 kids after 5 years.Cash Corpus is Rs 58 Lacs )Incl EPF) .Current monthly expenses in Rs 20,000 Rs.Pls advise whether current cash flow will meet the retirement needs?

Vicky,

Disclaimer first: I am not a financial planner or adviser. However, since you already know about your liabilities and monthly expenses, you may use the simple Excel sheet included here in this post to see how long can you push with your corpus. Use the last sheet for liability planning.

Sir,

I Feel more than retirement planning it should be termed as achieving financial independance. Once you achieve financial independance status you are free to do what you want. Since our whole country is turning out to be more captilistic, its always better for individuals to plan their financials to become more independant early and do what they want to do.

Regarding Financial calculator on retirement, most of the financial calculators are simple and provides a corpus you should have at the time of retirement. When you say corpus i think it should be the total asset value or the corpus which can be kept in different investments to generate the ROI you want post retirement. I feel when a financial planning is done things have to be little more complex than providing a corpus you want…

1. When you want to become financial independant at say 45, the remaining 35 years of your life can give you more surprises than you imagine, so be prepared for it.

2. When we say monthly expense post retirement, we should plan for living expense and investment expense (Monthly investment is always required even post retirement, but may not be to the scale of what you do before retirement)

3. More than the corpus required for retirement, it should be the total asset that you have and the split of those assets(dont include the house you live). Because when you sit on corpus you corpus stays as such and you live on interest. When you work on total assets, some of your assets might still groow and adjust inflation at later point of time to handle suprises.

4. Also when you include investment as part of monthly expense, it will also grow by itself when you give enough time to it, basically that would create more wealth.

5. A simple example to say why the financial independant calculator have to be complex including total assets. Say for e.g if for a monthly expense of 50000(living expense) post retirement you get a retirement corpus of say 4 crores. Say now you have MF/Real estate assets as 2 Crores and 1 crore in debt instrument and you have not met the corpus, still you can retire though you have not achieved the corpus, because your 1 Crore can generate 8.1L interest post 10% taxation and you might get atleast 3% from your rental assets, which can match your expense of 6L per year for next 8 years. After 8 years ideally your investments in Real Estate/MF should have doubled and your corpus in debt instrument stays same meaning your 2 crores will be 4 crores and 1 crore in debt which makes your total asset to be 5 crores which actually exceeds your initial corpus requirement and you can reallocate yours assets if required. This is the reason i am saying the calculator has to be little more complex.

Nice calculator. Here is a constructive feedback – breaking the calculator to smaller parts can help. Also some charts may be useful.

I am 54 and want to retire at 55. Monthly post retirement expenditure will be rs.25000.00.No liability except one kid’s marriage.

What should be the corpus with which I should plan?

Regards

Jayanta B

Jayanta,

Please use the sheet enclosed in the post. It’s rather easy to use. As for the liability, it depends on how many years after your retirement the kid’s marriage takes place.

Hi Ajith,

I hope that you’re retirement is going as per your plans. Best wishes for the same.

I’d like to thank you for the spreadsheet that you’ve so generously given. While using it, I’ve noticed that for fixed monthly expense, fixed inflation values & fixed post-retirement return, changing the pre-retirement return to any value, DOES NOT make any difference to the Retirement Amount which is needed.

Has this been formulated in this manner?? As the sheets are locked, cannot check the formulae to understand the logic.

If you could kindly help me understand the same.

Thanks & Regards.

Rakesh,

As mentioned in the last line of the ‘Help’ tab, C13 is always fixed. This is the money you would need to lead a retirement life as per the inflation, longevity parameters. This wouldn’t change when you change C10 value (the return rate till retirement), but will change values in C19 and C21. These cells are the monthly SIP requirement or bulk investment required to achieve column C13. Hope it’s clear now 🙂

Hi Ajith,

Great blog. Very insightful and helpful for people with similar thoughts. I am planning to retire early..couple of months from now. Reason is I am tired of the corporate world and the way it operates. I am 38. I am fine with the financial part by some good investments, however I need to know about the other aspect of this decision.

1. Does the sudden change in the pressure cause any concern? E.g. Working 10-11 hrs (5 days a week) to no work.

2. Any activities you explored post retirement which have been fulfilling? Your direction can be helpful here as I dont have a specific plan except spending time with my kid and nurturing him (no pecial needs here though).

3. You mentioned blogging and online marketing. Are you doing it and if i may ask – how much percentage of the monthly expenses does it cover for you?

Would be great if you could comment back with your views.

Thanks,

Ashish.

Ashish,

Thanks for your comment. Yes, there are some non-money related issues that might crop up once you are at home full time. Some people might develop depression post retirement regardless of the financial security. This is mainly because you are suddenly left with a lot of time and not many people to interact with. It, hence, makes sense to start some hobby or charitable trust activities to keep one engaged. I am a part of our apartment management committee and there’s some work and interaction on that front. The other issue is that if your wife is at home too, there’re more altercations and small fights all the time. You have been having your respective spaces for a long time and suddenly you are at home full time. This can lead to some minor troubles 🙂

Yes, I do blogging and online marketing. I haven’t monetized this blog, but some other blogs do make money for me although I wouldn’t like to discuss the numbers. It’s not as good as my salary but definitely good enough for a living.

Great post Ajith !!

Most of ppl i know are just amassing wealth and buying real estate, gold. They dont kno why dey r doin it. Numbers are making dem more greedy I guess.

By becoming financially independent and reducing expenses. We can enjoy our lives happily.

We need more ppl thinking like u. Salute man !

Hi Ajith,

Really excellent article, I was searching long time for such a article to content myself…..Im 33 now, plan to retire at 40.

Presently working in oil field – drilling. plan to join as an faculty (part time or guest) in Engg. college, and part time agriculture business. I want to spend time with family, friends, kids, relatives, festivals, family functions etc…..

Most of us making and running behind money…..near 40 years they will have wealth like sugar, BP, Cholesterol, kidney stone etc……for life long…..

Dont know how to limit our commitment, its keep adding.

Please share….how to make our life simple. how to live happy.

Thanks

Tharunkumar

Hello Ajith, Your websit gave me eaxactly what I was planning for. I had worked in the IT industry in US for 15 years and planned to return back to chennai for an early retirement. As you had said, I have some decent savings and fixed assets which I had wisely invested during my career. Returning from US for good is not an easy one, as people think I am crazy to go and live in difficult environments in India. But the love for my hometown, culture, food and people have overcome this all. I am not going to miss any of my loved ones, anymore, back in India. That gives me overwhelming encouragement to return back, with an early retirement. Thanks for your post.

Found this very useful for women like me who do not understand the complicated maths/ financial aspects behind planning for the future. Have also shared it on my personal page.

Lots of uncertainties for a IT professional after age 45, Every one should be prepared for early retirement at age 50

Hi Ajith,

i was under real confusion to take a decision on my retirement. Now i am clear and will retire at 52 years. thanks for sharing your thoughts. But i really wonder, why people aged around 60 years, seriously try for a second career, competing with youngsters and run here and there? any views on this?

Gurunathan.

Retirement decision is first about financial planning to take you (and dependents) through the rest of your life and then on how to keep you busy and occupied post retirement. Those who look for a job at 60 haven’t met either their financial needs nor occupied themselves to kill boredom.

Hi Ajith,

Nice post and the fact that it is read and asked questions about is a testimony of its relevance to large audience.

I stay in a metro city, own two houses (both joint with father) with a loan just over 10 lakhs to be repaid. I am 33, unmarried and only son to my father and mother. I am going to inherit the two houses and some other tangible assets.

Although I work with an IT firm, my current salary PA is just above 7 figures (I started corporate job late).

I have investments in PPF/Unit Link policies and insurances. I am planning to retire at 40 and like you mentioned, try to pursue a part time/alternate career path.

Given my marital status (chances are that it will remain so) and other details I provided, do you think it would be possible for me to retire at desired age? I don’t have an exuberant life style.

Will appreciate your advise.

also, it would be interesting for readers to read your experience so far post retirement. Are you still happy with the decision.

Thanks in anticipation,

Ashu

Dear Ajit,

Nice article.

I am trying to plan the same. curently 39 and planning to retire by this year end to my home town

Is it possible to discuss personally ? Needed some guidance

I am an indian only ( random email id ).

Thanks

Best Regards

Amazing blog. In a way, it gives very good confidence to think towards early retirement. I’m 38 and I find Indian IT corporate offices becoming money minded and either humiliate experienced/aged employees or fire them giving lame excuses.

One good thing is I have got H1B and planning to achieve my financial goals migrating to US. Hope I meet my targets very soon and plan for retirement at 42.

Good information and best of luck. Thanks for Sharing this perspective and knowledge.

Dear Ajith,

Good article.

thanks and regards

After all that big discussion, I do not find any excel – mentioned in the blog.

It’s pretty much there Alok.

So, Ajith i hope when writing to you there has been a year or so passed since your retirement, I am 37 but planning an early retirement please share the experience till now

Things are going good so far Manuj. Thanks for asking 🙂 The following is the summary so far – pluses as well as minuses :-

+ The wealth appreciation is on track – my long term equity and debt funds are appreciating well (retirement wealth portion as well as kids education part)

+ My blogging and Internet marketing work from home activity is earning me enough money to pay the family monthly expenses (although not a match my IT salary I used to get)

+ FDs that I blocked for long term for 9% to 9.25% interest rate was a good decision (read below)

+ After a long 14 year gap, my wife could resume her career and she’s happy about that

+ Have a lot of time to spent with kids

– Some FDs are maturing soon and there’s no real FIXED return instrument that makes more than 8% now. Interest rates have come down.

– Interaction and networking opportunities are limited these days. It can be depressing unless you do something else. I used to play badminton with a group of people but now it’s discontinued 🙁 I am contributing towards our Apartment Society’s committee in my limited capacity as well. Need to find something more to kill time 🙂

– You can degrade really fast in terms of knowledge and expertise. At the moment, I don’t understand software as much 😀 But I am trying to read more on other topics and get different perspectives of life.

In short, if you are ready with the following, you can retire peacefully: Reasonably wealth that’s further appreciating, Some part time activity to keep you busy, Opportunity to network and keep in good mental and physical fitness.

Hope this helps.

Sir, some of the corporate FD’s are still giving 8.75%.

Yes, Sivakumar. However, I am not inclined towards corporate FDs as their credit ratings and fundamentals need continuous monitoring. Perhaps, I shall wait for the next tax-free bonds from the government which I think is a great instrument for the next 10-15 years.

i liked the humour loaded expressions about your retirement. i am mother of two sons in their 40+

Hi Ajith,

It was very nice reading your piece. How are things going? I’ve been planning retirement for the last 6 years. I will retire in December after I turn 46 and was looking for some encouragement as I see a lot of opposition from friends and family.

I have a diversified stock portfolio which will give returns of between 10-12%. Like you, most of my portfolio is large cap for long term investment. I do swing trading as well, with small caps.

Unlike you, I will continue to hold my real estate investments – flats giving rent of 30000 pm, because I believe they’ll provide inflation beating returns. Only time will tell.

Your calculator has generated a number – 4,32,86,655 for me. Is this a corpus of Rs. 4 Cr odd that I need in hand or is it my planned net worth at retirement.

I’m interested in teaching school children, Maths and Science. I want to learn to direct (film & TV) over the next year, and make socially relevant short films.

Thank you for your time and effort. I also enjoyed your cookery pieces, on the Mathi curry, and the Kerala porottas.

Are you based in Bangalore? If so would definitely love to meet you at some point in the future.

Best wishes

Praveen

Praveen,

Good to know about your plans. If your monthly expenses are high, the figure of 4 odd crores as the corpus requirement must be true 🙂 But did you deduct your rental income from the expenses part? On that front, yes, apartments in prime areas will definitely yield good returns in terms of rental income.

Teaching is a great post retirement hobby – one of my neighbours does it for charity and he’s an extremely happy person now.

Yes, I am based out of Bangalore. Good luck with your retirement plans and hobbies. Directing films sounds interesting 🙂

I landed up in your blog while searching “early retirement in India”. Thanks Ajit for proving my decision on retirement is correct.

I am 42 and having two kids (Girls) pursuing 10th and 8th in USA. I am thinking about my retirement from last couple of months but was unable to take decision as my liquid corpus is about 50 Lakhs. And I have real estate assets worth of 1 Cr which is giving around Rs.15000/- as rental income. I can not make a huge corpus even after two years from now. If I sell all my real estate properties; then I can create corpus between 2 Cr to 2.2Cr. If I go to India today; I am not sure how much is my monthly (moderate life) expenses. I have a mortgage-free house in Hyderabad; So I don’t need to pay any rent.

I am thinking about my kids education and marriage – both are major events in my life; and this requires huge money after few years.

I am actually tired with my 9 to 6 IT job, and would like to pursue my hobbies, spend more time with my kids and support them in their education (I was a Mathematics tutor before entering into IT field).

As I am 42 now and not that old to sit at home; I am planning to do some part time jobs (mostly teaching, web Design, photography etc.) after retirement.

I am stuck with my retirement planning with all these financial obstacles.

Ajit, what do you think about my financial condition for retirement? How much do you think my monthly expenses would be? How much more corpus fund needed to retire this year / may be in two more years?

Thank You in advance.

Anand, it depends purely on what you consider as your moderate monthly expenses, growth expected on your corpus going forward and how much money you can generate via your hobbies or part time job. Please use the excel sheet here to get some idea, if not the whole picture.

Hi Ajit, I am impressed by your decision on early retirement at such a young age and all the planning behind that decision. I work for a multinational IT company in India. I worked for a few years in US before moving to India. I was doing fine at my company until 2011 after which like in all other India based IT companies the work environment got very toxic due to politics, frequent reorgs, back-stabbing, high stress, long hours, unhappy people, groupism, favoritism, perception based appraisals etc. Every year end you are not certain whether you will have a role next year or not. I have seen many of my seniors sidelined and forced to leave the company which is very humiliating after you have put in so many years of hard work for the company. I don’t want to end up like them. The company has also grown so big that you feel like just a number in a crowd of thousands. You should see the scene in our cafeteria where people really jostle for seats, plates, spoons etc. I am 50 now and have been contemplating early retirement by age 52 from IT career and doing something different with my life. Financially, I have set a target of having a corpus of 3.5 crores by age 52 which I should achieve in next two years by adding savings from my salary/bonus and return on my existing corpus.

I have used your retirement calculator with the following inputs:

Expected Monthly Expense post retirement – 150000

Expected return till retirement – 7.5%

Expected return after retirement – 7.5%

Inflation – 4%

Logevity – 80

I have set aside a very generous amount for monthly expense to maintain the current life style which includes shopping and entertainment, two family vacations in a year, gym memberships, 15 lakh health insurance cover, two cars & driver, cook etc. I invest only in non-risky instruments such as FDs, Tax Free Bonds and Debt Mutual Funds. I have one child for which I have set aside 30 Lakhs in FDs for higher education and marriage. This will be over and above my target corpus of 3.5 crores. Your calculator also gives an amount of 3.5 crores which makes me believe I am well positioned financially to take the decision of retiring in two years. I don’t have any loans to repay. I live in a 3 BR house in Mumbai which is worth 3 crores today. Once our child is married and settled, my wife and I have also thought about moving out of Mumbai to a tier-2 city given the fact that Mumbai is one of the most expensive cities in the world and the cost of living and traffic are getting worse day by day. We can get 3 crores+ from our Mumbai house, buy a decent house for 2 crores in a tier-2 city and add additional 1 crore to our retirement corpus.

Now I come to the main point where I need your views. My concern around early retirement is what my wife, child, other family members and friends will think if I announce early retirement. The general belief is that how can the man of the house not work? My wife says that I need to find an alternate occupation before I take the decision(for example, take up teaching, work for an NGO, start a small business etc). Do you agree on my assessment that I am financially ready to retire in 2 years and provide your views and suggestion on what people will think and the alternate occupation that I can pursue?

Thanks and Regards

Rajiv,

Looks like you are reasonably well placed with respect to your finances. However, I request you to play around with the sheet with an assumed inflation of at least 6% and the longevity from your wife’s point of view (if she’s your dependent, that is). The reason is typically women outlive their husbands by five or ten years (or even more) and your aim should be to plan from that angle. The problem with depending purely on FDs or Debt Funds is that in long term – sometime during our life time – we may see the returns dropping to 4 or 5% or even lesser. Hence, consider a part of your corpus sitting in equities as well.

As for the other aspect of retirement, your wife is right that you have to keep doing something – not necessarily from earning point of view but to keep yourself busy 🙂 But 52 is not really an early age to retire.

Best wishes for your plans.

Hi Ajit, thanks for your reply and your suggestion about investing part of my corpus in equity. How do I get started in equity? I guess I should go for mutual funds considering I don’t have much experience in equity investment. What percentage of my corpus should I move to equities considering my risk appetite and can you recommend top five funds that I can consider?

Rajiv,

My allocation to equities is about 35%. And yes, majority of it is in mutual funds. The following is the basket of SIPs that I am running.

1) Axis Long Term Equity Fund

2) * Birla Sunlife Frontline Equity Fund / HDFC Balanced Fund

3) ICICI Prudential Value Discovery Fund

4) Franklin High Growth Companies Fund

5) Franklin Smaller Companies Fund

You might want to take expert opinion on the above funds as well as the right allocation for you. During my retirement, I did talk to a few friends who work in banks and AMCs and decided on my asset allocation as follows:

Equities/Equity Funds: 35%

Debt/Bond Funds: 15%

Long Term FD/MIS: 35%

Liquid Funds**: 10%

Gold ETF: 5%

* I have stopped HDFC Balanced Fund SIP, but keep buying it at times to increase Debt exposure

**Liquid funds are kept so that any huge correction in the equity or bond market over the years can be tapped into. The above figure is not exact to date as SIPs are still running including mutual funds (and from time to time some equity / Gold ETF purchase takes place)

Hi Ajit,

Your 100% allocation does not include real estate ?? Other than the house you live.. should not 100% include the asset value of the extra house owned. I am asking this in general. Normally even if there is one extra house.. the asset allocaiton changes drastically.

Sivakumar,

I do not have any real estate investment 😮 i.e. I do not own anything other than the flat that I live in (which is of course, not an investment but my home). Of course, there’s some ancestral land and a house back in my native place and a part of that may come to me at some point of time. But that’s not part of any of my plans!

I agree with your point. If one is having real estate investments, that need to be part of the overall allocation as well. Personally, I feel that real estate investments (illiquid asset) may not be ideal for (elderly) retired individuals although early-age retirement can think of some allocation. To be frank, I do not know what should be an ideal allocation towards real estate in such cases.

Dear Ajith

As mentioned by you, future you’re going to invest in Tax -free Govt bonds.

When n where to purchase?

How does it work?

Once issues opens.. how do we come to know?

My knowledge is limited, Please explain in brief.

Although you aren’t a financial adviser, but you are very good in arriving it fin. related calculations.

Lastly, your excel doesn’t open. Earlier it was…

Keep watching the news paper/TV ads for tax-free bonds for the year 2016-17. I am hopeful of hearing some news around Feb-March time frame. These bonds can be purchased at designated banks and they work like any other bond which returns a certain % interest (either quarterly, half yearly or annually) on your bond investment except that the returns are tax free, this time.

The excel sheet still opens. I verified it.

Hey Ajith,

Kudos to you for the decision and the well done with the steps taken to reach there.

I am 38 and being financially free has been on my radar since a few years now. I am looking at hitting it when I reach 45.

I live overseas and have two kids (under 6). I have a paid off apartment in Thane.

I input the following values in the spreadsheet

———————————-

Your Current Age 38

Planned Retirement Age 45

Expected Monthly Expenses post Retirement (Without Inflation) 75000

Expected Longevity (Age at Death) 80

Inflation Rate in % 7.5

Expected Return (% of Interest) of Your Investment Needs Till Retirement 7

Expected Return (% of Interest) on Your Retiral Savings after Retirement 6

————————————————-

The results come to

——————————————

Monthly Investments (SIP or RD) Needed To Build Your Retirals (C13) -687,775

Or

Current Savings You Must Have in Hand To Build Your Retirals (C13) 46,257,196

—————————————-

I have that amount (4.6 Crs) currently on me, but I am a bit confused with the “Expected Return (% of Interest) of Your Investment Needs Till Retirement” and “Expected Return (% of Interest) on Your Retiral Savings after Retirement”

Can you shed some light on it? Does it assume that I would be investing in SIPs?

Raj,

First, thanks for reading the post and using the tool. As for your query:-

– C13 is the corpus you would need on your RETIREMENT DAY.

– C21 is the lump sum you would need TODAY to build a corpus of C13 assuming a return of C10. Ideally, this is the figure people like you (who would want to retire in the short to medium term) should look at.

– C19 is the monthly investment you would need (in SIP or RD) to reach the figure in C13. This is mainly for long term retirement planning, for those who have that cushion of 20 or 30 years before retirement. Please forget the negative value. It’s the result of using a certain Excel formula that indicates the outflow.

So, your assumptions are mostly right, except that it doesn’t need to be necessarily SIP. Even RDs would work if your targets are not aggressive (as in your case)

Sorry for the crude calculator, but it works to arrive at an approximate corpus figure you would need 🙂

Hi Ajit,

Excellent article on early retirement. One of the main reasons one cannot retire early (even though your calculator says you have enough) is what people will say. Family, friends, relatives. How does one overcome that? Do you have a personal mail id where I can communicate?

Shiv Ram, that problem is always there in the Indian context despite having taken care of the money part 🙂 You can always contact me via the Contact link on this blog which gets delivered to my personal mail box.

Dear Ajit,

In case one has the required corpus, as per your calculator, but the corpus is presently invested in FDs, Bonds, PF, PPFs mostly and some in mutual funds, what is the way to invest these amounts (in case we withdraw some of it) so that we can get a monthly income?

FDs and Bonds have periodical interest payout options. PPF is a locked mechanism but Mutual Funds can be in Systematic Withdrawal Mode (SWP). In my opinion, mutual fund SWP is closest to what retirees in developed nations do. i.e. Withdrawing a small portion of the corpus periodically.

Did you retire as per your plan? Who are the people who called it a day before 58 in India? It will encourage people like me. In fact my spouse wants me to consider, but I am scared because of the unstable financial policies by politicians in India. Happy retirement!

Hi Mohan,

Yes, I am retired for the past two and half years. So far so good 🙂

Hi Ajith, Very nicely and thoughtfully written article. I’m one of the many who wants to plan retirement after 16-17 years of IT career. I noticed that you posted this article in 2014. More than 2 years have gone by since you wrote this. During this period did you ever think that your planning was not correct or that sometimes you are overspending. Do you think that you have to cut corners if you want to do something that comes suddenly (for example attend a wedding of a relative). Most importantly, did you ever feel the need to go back to IT Career for better life style? If you think, my questions are too personal, you can ignore. I just want to know because I’ve a fear in mind about – “What if things don’t go as planned”

Regards,

Kirti

Hi Kirti,

Yes, it’s more than 2.5 years since my (early) retirement and things are going fine. So far, I haven’t felt that my planning and calculations are wrong as my investments are spread across multiple instruments. But you are right in guessing that whenever spend is high (e.g. we spent a bit too much on our vacation during Puja holidys :/ ), I get a bit tensed. But then that’s because we deviated from the plan. However, I do not exactly miss the IT life as I still believe that work to earn a good life and not the other way (i.e. living to work). You can have a good lifestyle with your family as well, not just at work place.

Hi Ajit,

I have been following this post and comments regularly. It is very nice to know people who have thought of this and implemented. I am also in one of them and currently chasing the dream. I am planning to retire in next 3-4 years. Let’s see if I can make it. But your post and comments give strength me (and hopefully many others who are thinking the same).

My question is about the old age life based on the corpus.

Calculations may prove the corpus will last long however, during our old age (after 20+ years for me), I always get worried about the medical expenses that time. Is there anything we can do for that like saving from the corpus interests/our monthly income or life insurance plan etc?

Also, is there a community, blog, or people stories you might be aware of where we can get similar encouragement and heard about their experiences so far with the life after retirement?

Suresh,

Yes. Medical expenses will keep going up exponentially and hence having a very good family floater insurance is very important on top of having a Term insurance plan. It’s important to take this family cover very early (and keep renewing every year) because nobody would give you a fresh insurance policy once you turn 65 or 70. There are some senior citizen policies but they are ridiculously expensive. In my case, I started with a 10L cover 3 years back and they keep adding more cover to it based on my claim status. Right now it stands at 13L.

Sr citizen policy is a crap n fraudulent. Gazed through the net to zero-in on National Insurance for my mom at 78 now. it said a max of 2 lacs even with preexisting disease and no medical tests. I spoke our family insurance agent, who then sent the forms. Encouraged, i submitted the forms n premium cheque fpr rs.12k thru him. Then came the twist after a week when our person informed me that it requires a few routine med tests. When i contested, he said that the branch manager only knew it right and as per him it is a must. I said ok and saw the form – the tests are very collaborative and could have costed me about rs.30000/-, which must be borne by me only… So, i have invest rs.42000/ to cover an probable eventuality,. I still wanted to go forward. Then came another BIG TWIST that the insurance will be applicable only after 2 years of waiting period if the person had any disease like BP, sugar etc, for an Indian female at 78. Someone who had insured told me that after all this they will only give max 50%. Bullshit insurance company and bull shit policy. Except LIC, rest of govt health insurance are mafia .

Nice work, Ajith. And good luck with your ‘retired’ life 🙂

I at 35, planned for my early retirement at 50. I did it slightly differently, focussing on investments of 50% of my salary and all of my bonuses, investing as below :

40% in high return/risk (Stocks, derivatives)

30% in low return/risk (MF’s, tax free SIP’s)

30% in risk free/inflation keep ups (gold, bank FD’s).

I am now 50. However, I havent been able to retire, as I moved my investment in stocks, that had become Rs 2cr to real estate in 2007 (phew) but while I escaped the meltdown, my income generating corpus is stuck and seems unlikely to turn liquid. And no, rent is very low, less than 1% of the property value.

A 20 lakh liquidity fund I had planned (withdrawals from PF) is stuck in a unpaid PF, an IT dispute, and balance of an educational loan.

Finally, the rainy day investments I had made in gold and bank FD’s are about 50% of planned – Rs 15 lakh.

Now, I plan to (a) use my liquidity corpus for income generation (Rs 8-9,000 per month) (b) participate in PM medical insurance scheme, special illness cover and (c) shift base to a small town to enable me to retire in 2-3 years from now, hoping that my property sales would happen by then.

Just thought of sharing this with other planners, so they can think through such situations that may occur at the cusp of the transition, or worse, post transition. A safety net against spiralling medical costs is definitely needed.

Hi Manoj, Thanks for sharing your story. Looks like you have done a lot of homework on this front. Yes, real estate entry after a certain age can put one into difficult situation of poor liquidity. With the recent crack down (demonetization) the real estate price might fall further for short term. I also see a trend of reduced number of transactions in this sector. Hope it’s a short to medium term issue and in the long term things should pick up.

I am 29 years currently and i am planning to retire from full time job to freelancer job.

I wish to know about investment plans for retirement.

Since you are switching from full time job to freelancing, you are still going to work and earn. Continue investing 20-30% of what you earn into long term mutual funds in a SIP manner. That’s all you need at this young age.

gr8t blog Ajit…good pointers

My story:

I am IT worker aged 32 and i am planning to retire by end of this year at 33. I spent some time in US and saved 1.5 Cr by being extremely frugal ie saving 40-80% of paycheck for 10 years.I have seen the massive recession and other ups and downs in career and know how risky our careers are for the unprepared.

I started freelancing 6 years ago and took up extra work to boost my side income and managed to make 1.8 cr more while maintaining the same frugal life style. I have been extremely disciplined at this. I plan to only take up side jobs post retirement at reduced stress levels in terms of work hours and spend more time with my beautiful family.

Anybody can achieve this as long as you put in some effort and make some sacrifices and give up some material superficial comforts. You have to set the goal as early as possible. No point in procrastinating.

Investments:

GOLD:

->Every one needs gold/silver in portfolio as putting every thing in financial assets is extremely risky. Gold is very liquid and does keep up with inflation and a good way to diversify your risk. Demonetisation is your wake-up call on why you need gold.

Real Estate:

-> RE is illiquid and does not produce income at the current prices and passive income is must if you have to retire early (you need income). So rent a house and don’t borrow money to buy one if you want a chance at retiring early. You can look at buying once you have decided on where you want to settle down and property prices cool off to realistic levels.

Stocks:

->I was a late entrant to stock investing as i was busy making money actively than passively and that has rewarded me handsomely. I have understood that you need to avoid big crashed to make money in stock market. So avoid investing in stocks when markets have gone up for many years and there is too much optimism in investors. Wait for a big correction when every one will be fleeing the market to boldly enter the market. This will increase your risk reward.

How much to retire and how to execute?

30 times your yearly expenses is a decent place to be…!

if your yearly expenses are too high move to smaller town post retirement (you need to sacrifice no other option).

Involve your family in your early retirement dream as much as possible so it becomes a team effort. You don’t need to hit jackpots to achieve the goal. My returns have been very modest but compounding is very very powerful.

Finally:

Do not lose money by gambling for higher returns with your savings….! Because its hard to make back what is gone…

All the best to fellow early retirement enthusiasts… 🙂

Great to hear you story 🙂 Yes, 25-30 times annual expenses is what most people recommend as corpus when you want to retire at 50 or 60. Your closure remarks are very valid. A lot of people lost their retirement money by gambling, day trading and playing with the derivatives market.

@SuperEarlyRetiree:: Great going “SuperEarlyRetiree”!! I am also in US currently and share the similar dreams. Is there a way to connect with you?

Suresh… email me … idocareforpeople @ gmail.com

Ajit..thanks for this detail blog. I have been following this for few years now, and completely agree with your comments, and also with blog responses. Nice.

What I would like to know after your year2 in retirement, as to how you are coping with expectations of your kids, as even they would also have the expectations in their peer group as to where their dad is working? So how is this communication really managed, and how it is turning out…your thoughts on the same.

Prashanth, the comparison culture among kids (or us for that matter) is not a good thing 🙂 All that I have told my children is that I have saved up and invested enough for giving them very good education and hence they don’t need to worry about that part. I think, it’s our job to convince kids not to judge people based on their designations, the house they stay in or the cars they drive.

I think Prashanth query may also brings an angle as to how to handle the others – be the friends, relatives and neighbours too who keep looking at you not starting your car for the day, for many days and then the query pops up as to ” sir, are you not keeping well?” You cant say a no, but how do you handle them ? becoz while we know our financials, managing such people may give some psychological distress as if we have done a mistake of a short career…etc…

(btw, I have taken a career break at 54 as i was in tech support and sales in an american healthcare MNC,almost exhausted with the full time devotion; people having known me as someone who is always on the move, refuses to believe that have taken a break and going for learning of vedas)

Haha… Mohan, you’re bang on with respect to the comments from relatives, neighbours etc. I have faced this as well – especially from ladies (typically wive’s friends, family people etc) – asking questions like. “Oh, what happened to him?”, “He looks sad and troubled”, “Has he lost weight? Not healthy??” etc. Once I even answered one of them “Yeah, I am fighting a terminal illness” and after that she shut up 🙂

Thanks Ajith. I agree with you on parents role, however the question was more specific to how kids manage within their network with such communications, and any such experiences…thanks much

Hi Ajith, Did you know people who have retired early by 35-40 yrs and are successful like you? Any instances that you know where people have regretted retiring early and going back to work again?

I don’t personally know anyone who retired between 35-40. And how ‘successful’ I am, only time will tell. I am hoping that my calculations are right 🙂

By the way, 35 years may be quite an early age to retire unless he has 50x or 60x annual expenses already saved up and invested wisely.

I took retirement when I was 47. its 5 years now and its going very well. yes, you are right managing neighbors and relatives might be tough in India but its your life which one get once only so one should not bother.

Thanks Ajit for nicely placed article for retirement.

I am considering the planning seems to be well.

I am feeling the biggest challenge is not in the planning yet in the executing, while safely landing meaning that how to withdraw.

What would be withdrawal strategy?

There are many many factors on this issue like age, existing portfolio blends(100% equity, or less and rest is in debt ), number of years of investments, No. of schemes investment made, market situation (bear, bull) etc. and many more.

Could you please suggest what are available strategies in the financial world to be used like equal withdrawal from every equity MF schemes or only high return schemes, or poor performing schemes first or something else? or even with the existing portfolio opt for the loan mortgage against existing portfolio?

Though this subject is very deep and complex, hence looking for ward for your expert view.

Dileep, yes the subject is much more complex. What I have provided is a simple calculator that give some hints on the corpus requirement assuming certain inflation and return on investment parameters. Withdrawal strategy (as typically discussed as part of retirement planning in United States etc) is beyond the scope of this article yet. However, the assumption in the calculator is that certain amount per month (inflation adjusted) will be withdrawn from your retirement investments.

Hi Ajith, I am planning retirement as soon as possible and live my dream life of being in mountains again with my family.

my calculations involved not more than 1 crore in cash (maybe we have different lifestyles)

1 crore in savings equals per year interest payout of 8 lakhs after tax deduction and per month inflow of 65000 INR. i can live life happily with that much money and even save a lot from it.

what are your thoughts on this?

Hi Ajit,

That was a very nice article.. I’m a 40 year old marketing professional and I am also looking to retire this year. I have investments in stocks, mf, gold and real estate of around 3.3 cr. I have no loans and live in my own flat. I hope to take up teaching and consultation assignments post retirement. Hope to earn enough for my day to day expenses. My life style is simple and conservative. I do have a young son and would like to give him the best education and other facilities. Let me know your views on the same

Thanks.

I am completely agree with your last point i.e. non financial one. I am planning to retire early and whenever discussing it with family I am facing a strong oppose from others.

Anyway thanks for your effort.

Hi Ajith,

This is great blog and site. I think you are lucky few who can retired early. But let me tell you, you have really worked hard, planned well and now enjoying the life where you are in-charge of your time. I am retiring soon, by middle of this year and at the age of 49. Feel lucky that I am able to do so.